Check it. Knowing when to sell stocks is a key to financial success. Find out the ONLY 3 reasons you should sell — and how to avoid losing out on investment growth. Ramit Sethi. NOTE: Need help getting your finances in order? If you encounter an ,oney expense and you absolutely need money to cover it, it might be a good idea to sell your stocks. You should be making investments for long-term savings goals such as retirement. You should already have a safety net in place just in case of emergencies. Be sure to check out my article on how to build an emergency fund for. If you believe the market will recover which it willthat means investments are on sale for cheaper prices than before, meaning not only should you not sellbut you should keep investing and pick up shares at a cheaper price. If you pulled up a list of your investments and saw di chart, what would you do? I need to sell it before I lose all of my investment!

More from Entrepreneur

Investing in dividend-paying stocks allows you to make money without selling your shares. Many people make their money on the stock market by following the old adage of buying low and selling high. However, that’s not the only way to make money — and it certainly creates a conundrum for you if you think the stock price is going to continue rising but you have no other way to get income from the company besides selling. Another way to make money is by picking stocks that pay dividends, which are payouts of the company’s profits to the shareholders based on the number of shares they own. Research the history of dividends that a company has paid out. A history of increasing dividends bodes well for future dividend payouts. According to the Kiplinger website, when a company consistently pays out dividends, shareholders come to expect the dividend checks to continue flowing, which in turn forces the company to plan ahead for making continued payments. Invest your money in a portfolio of stocks that have a history of paying high dividends. That way, you can expect to receive a steady stream of income without selling your stocks. In addition, if you find yourself needing money, there’s nothing stopping you from selling your shares and cashing out.

Latest on Entrepreneur

Hold the stock for at least 60 days of the day period starting 60 days before the ex-dividend date, so that the dividends qualify as long-term capital gains. If you hold it for less than 60 days, you still get the dividend but it’s taxed at the ordinary income rates. Because your long-term capital gains rate is always lower than your ordinary tax rate, this maximizes the amount you get to keep. Mark Kennan is a writer based in the Kansas City area, specializing in personal finance and business topics. Warnings Dividends aren’t a get rich quick scheme where you can just buy the stock right before the dividend and then sell it after. When a company pays a dividend, it’s stock price typically drops by the same amount of the dividend because the company is worth that much less. Dividends aren’t guaranteed, so no matter how well the company has performed in the past or how many consecutive years it’s raised its dividends, you’re not promised to receive dividends in the future. Video of the Day. Brought to you by Sapling. About the Author Mark Kennan is a writer based in the Kansas City area, specializing in personal finance and business topics. How to Invest in PayPal.

Video of the Day

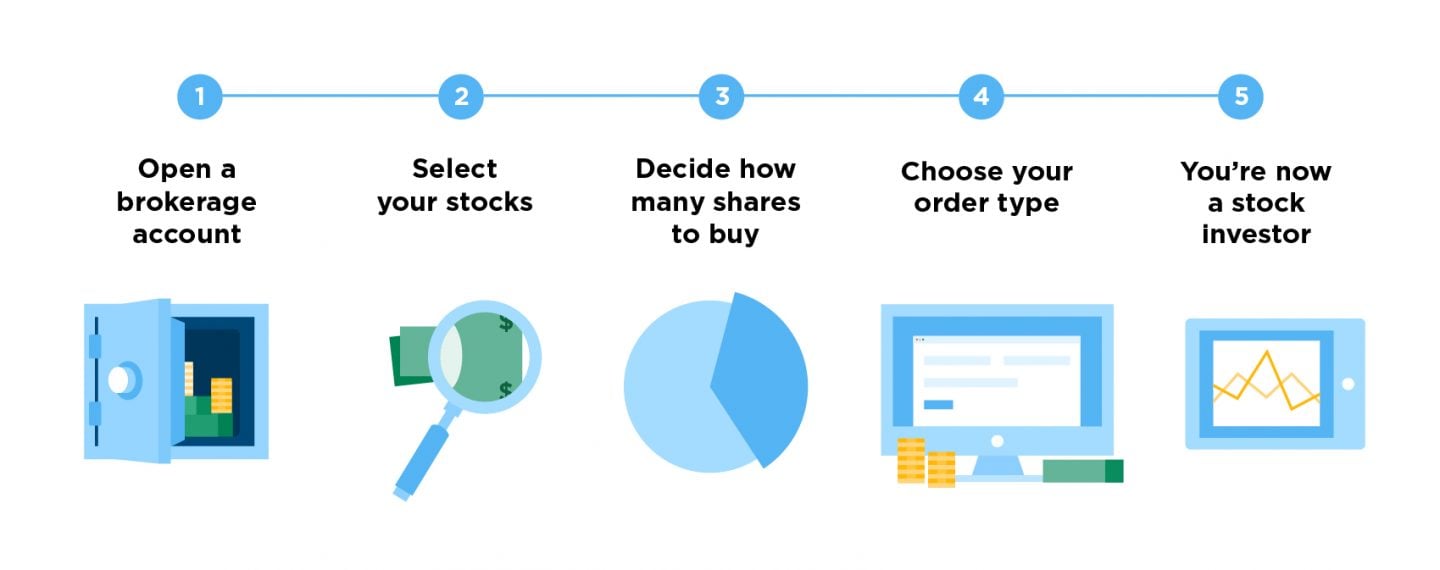

Unfortunately, investors often move in and out of the stock market at the worst possible times, missing out on that annual return. First things first: You need a brokerage account to invest — and thus make money — in the stock market. It takes only 15 minutes to set up. More time equals more opportunity for your investments to go up. The best companies tend to increase their profits over time, and investors reward these greater earnings with a higher stock price. That higher price translates into a return for investors who own the stock. Over the 15 years through , the market returned 9. No one can predict which days those are going to be, however, so investors must stay invested the whole time to capture them. Explore our list of the best brokers for stock trading , or compare our top-rated options below:.

Last Name. A technical analysis looks at the entire market and what motivates investors to buy and sell stocks. PE Paul Effiong Jan 11, Not Helpful 0 Helpful 7. In real trading, there will be a delay when buying and selling stocks, which may result in different prices than you were aiming for. In order to understand how people use our site generally, and to create more valuable experiences for you, we may collect data about your use of this site both directly and through our partners. As an example, you can view four popular stocks below to see how their prices increased over five years. Mutual funds are actively managed by a professional fund manager and include a combination of stocks. If you make more than a certain amount of trades per week, the Security Exchange Commission SEC forces you to set up at institutional account with a high minimum balance.

Special Invitation you don't want to miss: 👉Online Business Workshop. https://t.co/CnU0qZ9Tl2 pic.twitter.com/n5gtzcsuvv

— Real Deal Business (@RealDeal_Biz) February 3, 2020

Bottom line: Don’t sell your stock if you can help it

Too Much Testosterone, Science Says. Alternatively, you can donate, spend, or save up these dividends in cash. See Choose an Online Broker. What type should you buy? During the first decade after Wal-Mart went public, there were times in which it earned mae than a 60 percent return on shareholder equity. Don’t get so caught up on how you’re going to get wildly rich overnight.

There are two dell ways. The first way is when a stock you own appreciates in value — that is, when people who want to buy the stock decide that a share is worth more than you paid for it. They might decide that because the company that issued the stock has earnings that are yu, for example.

Three excuses that keep you from making money investing

If you hang onto a stock that has gone up in value, you have what’s known as unrealized gains. Only when you sell the stock you can lock in your gains. Since stock prices fluctuate constantly when the market is open, you never really know how much you’re going to make until you sell. The second way is when the company that owns the stock issues dividends — a payout that companies sometimes make to shareholders. Ultimate guide to retirement. What is a mutual fund? Taxes and retirement. NEXT: What are dividends? Millennials squeezed out of buying a home. Big Data knows you’re sick, tired and depressed. Your car is a giant computer — and it can be hacked.

Comments

Post a Comment