Depositing checks by mobile device maoe usually pretty great, as using your smartphone camera saves you a trip to the bank. Nearly 6, institutions offered mobile check mboile to their retail hw, with nearly 80 million using the service, according a research report by Celent. While it has been a game-changer for the way people deposit their money, there are few things you should know before using it. Some banks offer same-day deposits, but not all. Many banks also have a set cutoff time for deposits to be available immediately. After you deposit a check with your mobile app, you might be left with a uneasy feeling. It might be tempting to destroy them, but the Pew study found that 76 percent of banks want customers to hold on to checks for some period of time after depositing. Store them somewhere secure, because should your money disappear into the ether, it can be really hard to get the issue resolved without a paper trail. You may also like.

How to Make Money on the Internet

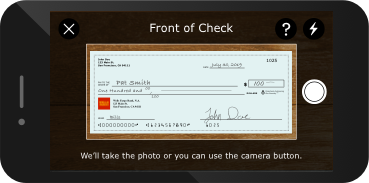

Depositing checks can take seconds with just a few clicks on your smartphone. A fee may also be charged at some financial institutions. For security reasons, many banks restrict the amount you can send remotely. Then, confirm that your check stays within those limits. Capture snapshots of both the front and back of the check, leaving some space on all sides and keeping everything in focus. Make sure the check is going to the right account and that all other information, including the amount to be deposited, is correct. Your bank may notify you when a check is accepted either through its mobile app or a follow-up email. Like any deposit, it may take from a day to a week for mobile checks to be processed, depending on the bank and when you made the deposit. By following these steps, you can make a mobile check deposit without causing any errors, processing delays or unexpected fees. You can save time by sending checks from almost anywhere at any hour without worrying about finding the nearest branch or ATM. Spencer Tierney is a staff writer at NerdWallet, a personal finance website.

Transfers through Western Union

At NerdWallet, we strive to help you make financial decisions with confidence. To do this, many or all of the products featured here are from our partners. Our opinions are our own. We want to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Any comments posted under NerdWallet’s official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise.

How to Apply

Use the Regions Mobile App to deposit funds into your Regions checking, savings and money market accounts, or load your Regions Now Card. After submitting the check image and confirming your receipt of the funds, securely store your check for 30 days. Regions provides links to other websites merely and strictly for your convenience. The site is operated or controlled by a third party that is unaffiliated with Regions. The privacy policies and security at the linked website may differ from Regions privacy and security policies and procedures. You should consult privacy disclosures at the linked website for further information. Content Type: Video. Content Type: Article. Mobile Deposit Digital Banking close video.

Digital Banking

Banks with mobile checking often offer a mobile check deposit feature that lets customers deposit a check on the go through an app using a mobile device with a camera. Learn how to use mobile check deposit so you can cash in your earnings quickly and easily. Go to the mobile banking section of your bank’s website to determine whether your bank or credit union offers mobile check deposit. If it does, the website will often provide a download link to the bank’s mobile app. Download the app onto a mobile device with a camera—Android, iPhone, and Windows devices are typically supported. Imposter apps that can steal your banking information may on occasion be listed in official application stores. Include any endorsement required by your bank. A signature in the payee section at the top of the back of the check may be sufficient, but your bank may require a restrictive endorsement that restricts the payment to a particular person. This may include the amount of the check, the account where you want to deposit the funds, and notes to yourself about the check. In general, the mobile app will guide you through the process of snapping a photo of the check from your mobile device. Get a clear, well-lit photo that captures the entire check. Verify that the images are clear before submission. Some banking apps will automatically take a photo of the check when the camera is positioned directly over the check. To ensure crisp images, make sure that all four corners of the check are within the guidelines shown in the app.

1. Blogging

Gotta love stuff this easy. Learn why people trust wikiHow. Ibotta will match the items you bought to the offers you selected and give you the cash! Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. When prompted by the ATM, either before or after making the actual deposit, enter the total amount of your deposit. One common maximum for a stack of cash is 50 bills. My mom feels she has the need to work from home so that she could take care of my little sister. You must be available 4 hours a day, 5 days a week minimum of 20 hours per week, 40 hours max. Wait for your deposits to clear. What do you think about Forex and investing in the stock market? Maybe this helps?

Our team is more focused on servicing your business as we know our success is based off your success! pic.twitter.com/knscIwLYeS

— G Map Pros (@GMapPros) February 3, 2020

Make deposits the easy way through this convenient banking feature

Find out when deposits will be credited to your account. Your cash back will be deposited into your Ibotta account within 48 hours. Log in Facebook Loading No problem, glad you enjoyed them! To another wallet. Create an account. Verification code expires in 30 days. JF Jacinta Fernandez Apr 21, Write the total amount down on a scrap of paper beforehand if you need a reminder.

TAP. SNAP. DEPOSIT.

People usually think of ATMs Automated Teller Machinesor cash-points, as a place for withdrawing cash from a bank account. However, many ATMs allow you to deposit money as.

If the ATM requires an envelope, fill out a deposit slip and put it in the envelope with your check. To find out how long it usually takes for your deposit to clear, keep reading! This article was co-authored by Michael R. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas.

Log in Facebook Loading Google Loading Civic Loading No account yet? Create an account. Edit this Article. We use cookies to make wikiHow great. By using our site, you agree to our cookie policy.

Article Edit. Learn why people trust wikiHow. Co-authored by Michael R. Lewis Updated: March 29, There are 5 references cited in this article, which can be found at the bottom of the page. Method 1. Verify that the ATM accepts deposits placed in an envelope. Smaller ATMs and those at non-bank locations such as convenience stores or restaurants may not have this function.

Some modern bank ATMs may only accept non-envelope deposits. See elsewhere in this article for information on making such deposits. Your bank may not permit deposits at ATMs not affiliated with it. This part of the process is exactly the same as when you withdraw cash.

Endorse any checks to be deposited. Sign them on the back in the marked area. If you lose this endorsed check, it can only be deposited, not cashed. Prepare a deposit slip. If you are using a slip from your checkbook, your name, address, and account number should already be on the check. If you are using a blank deposit slip, like those available in a bank branch, fill out your name, address, and account number.

Add the date to any type of deposit slip. Enter the total amount of cash to be deposited on the marked line, and individually list checks in the provided slots on the front and, if needed, back of the slip.

Enter the total amount of all checks and cash to be deposited on the provided line. A signature is only required when you seek cash back from a deposit made at a teller window. You may want to sign your checks and prepare your deposit slip ahead of time, for convenience and safety. Limiting your time at the ATM is safer and less likely to annoy those in line behind you.

Use the deposit envelope provided by the ATM. Older machines may have a small door that you lift open to reveal deposit envelopes, while newer machines may just spit them out of a slot. Even if you have your deposit organized into an envelope, transfer it to the one provided by the machine. Make sure you insert all your checks, cash, and the deposit slip into the envelope. Seal it securely. Write in any information, such as name, date, and the deposit amount, requested on the outside of the envelope as indicated by labeled blank lines.

The ATM may ask you if you need more time while preparing your deposit. Press the indicated button to give yourself added time to get everything in order. Insert your completed and sealed envelope and verify your deposit. The slot where you insert the envelope should be clearly marked and may be indicated by flashing lights.

It may also be the same slot where you received your deposit envelope. When prompted by the ATM, either before or after making the actual deposit, enter the total amount of your deposit. Write the total amount down on a scrap of paper beforehand if you need a reminder.

Take care to be accurate. The bank should be able to correct any discrepancies, but it is quicker and easier to get things right the first time. How to make money from mobile deposits that you want a receipt and keep it for your records, at least until your deposits clear.

Wait for your deposits to clear. Deposits of cash or check by envelope are manually counted and entered into your account, so funds will not be available immediately. A common wait time for fund availability from an ATM deposit is the second business day after the deposit.

That is, if you deposit the funds on Monday, they will be available Wednesday. But, if you deposit them Sunday not a business dayit will also be Wednesday. Banks are required to consider ATM deposits made by noon to be made that business day. Method 2. Verify that the ATM accepts no-envelope deposits. This is increasingly becoming the standard in ATMs at bank branches, and it is becoming more common in other locations.

Look for notices on the screen or on the machine. Insert your card, enter your PIN, and follow the prompts to make a deposit.

The ATM will verify at some point whether you can make no-envelope deposits. Endorse and prepare your checks. You will not need a deposit slip for a no-envelope transaction. You may want to add up the total dollar amount of your check deposits beforehand, in order to compare to the total tabulated by the ATM. You will be able to go through deposited checks individually if there is a discrepancy. Feed checks into the marked slot when prompted.

You do not need to feed the checks individually at most newer machines. The maximum number of checks you can feed at once should be displayed on the screen or machine; one national bank chain states a maximum of 30 checks at. Make sure that the total amount is correct and complete your transaction. You should be able to go through checks individually and make corrections if needed. Many machines offer the option of printing an image of the front of your check s on your receipt.

Rejected checks — those with unreadable printing or handwriting, for instance — should be returned to you at the end of your transaction. Contact the bank if this does not happen. One common maximum for a stack of cash is 50 bills. Unlike envelope deposits, where they can be deposited together, cash and checks will need to be deposited in separate transactions. Find out when deposits will be credited to your account. This will vary by financial institution.

One advantage of non-envelope cash deposits is that the money is immediately available in your account because it has been scanned and confirmed. Envelope cash deposits, on the other hand, need to be opened, counted, and entered.

Check deposits will still require time to clear after being posted; one national bank considers non-envelope check deposits made by 8 pm to be posted that business day, and it should clear on the second business day after posted Monday, cleared Wednesday, for example.

Each bank has a policy regarding when you can access funds after you make deposit through an ATM. Generally, funds will be available on the second business day after deposit, although the bank may allow partial withdrawals in the interim. Factors that affect fund availability include the nature of the deposit cash, electronic funds, paper checksthe amount of funds deposited, the customer’s history and relationship to the bank, and the source of the deposit bank-owned or independent ATM.

Check with your bank to identify their specific policies and procedures regarding availability of deposits. Yes No. Not Helpful 7 Helpful Many banks offer cardless access to their ATMs for deposits and withdrawals, typically through free mobile phone apps.

Check with your bank for their policy and process to proceed without a debit card. Not Helpful 10 Helpful Not Helpful 0 Helpful 1.

Yes, it is generally very safe to deposit cash into an ATM to transfer it to your account. However, errors can occur, so if you’re making a large deposit, you’re better off depositing it at an actual bank location. Not Helpful 0 Helpful 2.

Play Games For REAL MONEY Free! (PayPal Deposits)

Plastic Yandex.Money Card

Mobile Deposit TAP. Simply log into your Bank of Advance Mobile app, snap a picture, and deposit checks easily and securely without making a trip to the bank. Save time, hassle, and money with Mobile Deposit! You will need to be a bank customer for at least 30 days before you are eligible for this service.

You may also like

After we receive your application, we will process your request and contact you upon review. You will receive an email with further instructions within 2 business days. Apply Now. Usage restricted to eligible customers. On the back of the check, sign your name, and underneath your signature clearly write «Mobile Deposit Only». If your check is not properly endorsed, we cannot accept it through Mobile Deposit. Call us at if your deposit limits need to be temporarily raised. Deposited funds will be posted to the account after daily processing is complete. All deposits are subject to review and availability of funds may be delayed at our discretion. You should keep your deposited check in a safe place for 10 days.

Comments

Post a Comment