This week I answered questions from readers who are running into difficulties with premiums and tax credits on their marketplace plans. Last year I bought a single policy on the health insurance exchange. My husband gets coverage through the Veterans Administration. If the marketplace rax a mistake in figuring our tax credit, do we still have to pay the money back? SSDI counts as income when figuring your eligibility for premium tax credits, but disability insurance payments received from an employer policy may or may not count as income depending on who paid the premium, says Karen Pollitz, a senior fellow at the Kaiser Family Foundation KHN is an editorially independent program of the foundation. Perhaps you or of marketplace entered information incorrectly, transposed figures or made some other manual or computer entry error. By early February you should receive Form A from the marketplace detailing how much you received in tax credits for reconciliation purposes. It will be important to use that to make sure your calculations on Form are correct. But the amount of premium tax credit I receive will go. What can I do?

How to qualify for health insurance subsidies

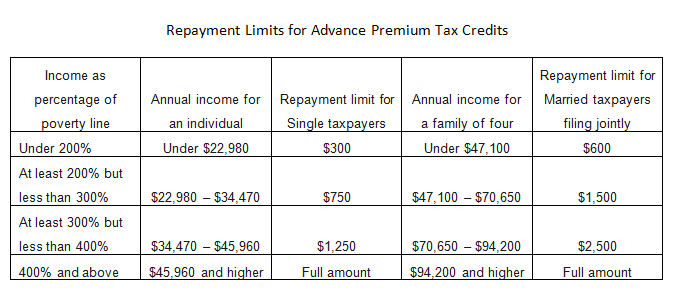

If recipients end up earning more than anticipated, they could have to pay back some of the subsidy. But the portion of an excess subsidy that must be repaid is capped for families with incomes up to percent of federal poverty level. Details regarding the maximum amount that must be repaid, depending on income, are in the instructions for Form , on Table 5 Repayment Limitation. But there are new rules as of that make it less likely for people with income below the poverty level to qualify for premium subsidies based on income projections that are above the poverty level. This is explained in more detail here. GOP lawmakers considered various proposals in that would have eliminated the repayment limitations, essentially requiring anyone who received excess APTC to pay back the full amount, regardless of income. But those proposals were not enacted. For coverage, subsidies were reconciled when taxes were filed in early The IRS reported in early that about 3. We do not sell insurance products, but this form will connect you with partners of healthinsurance. You may submit your information through this form, or call to speak directly with licensed enrollers who will provide advice specific to your situation.

If your employer offers health coverage

Read about your data and privacy. The mission of healthinsurance. Learn more about us. Federal poverty level calculator. Gross income. Weekly Annually.

When you enroll in coverage and request financial assistance, the Marketplace will estimate the amount of the premium tax credit you will be allowed for the year of coverage. To make this estimate, the Marketplace uses information you provide, including information about:. Based on the estimate from the Marketplace, you can choose to have all, some, or none of your estimated credit paid in advance directly to your insurance company on your behalf. These payments — which are called advance payments of the premium tax credit or advance credit payments — lower what you pay out-of-pocket for your monthly premiums. If you do not get advance credit payments, you will be responsible for paying the full monthly premium. If you or someone in your family received advance payments of the premium tax credit through the Health Insurance Marketplace, you must complete Form , Premium Tax Credit. You will receive Form A, Health Insurance Marketplace Statement, which provides you with information about your health care coverage. Use the information from Form A to complete Form to reconcile advance payments of the premium tax credit on your tax return. Filing your return without reconciling your advance payments will delay your refund.

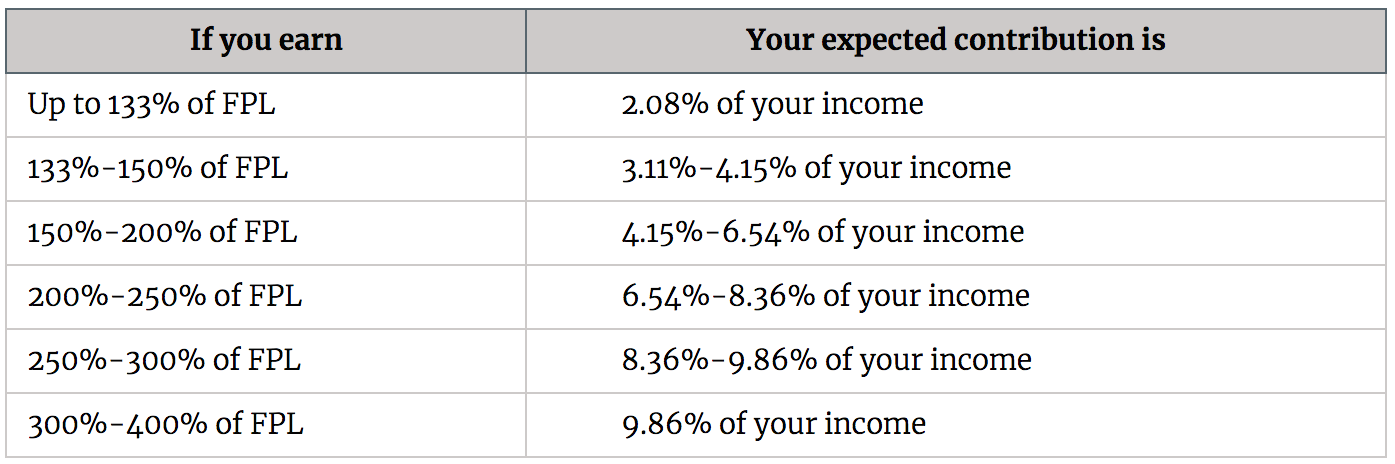

As a result of the Affordable Care Act ACA , millions of Americans are eligible for a premium tax credit that helps them pay for health coverage. The ACA created a federal tax credit that helps people purchase health insurance in health insurance marketplaces also known as exchanges. People can choose to have payments of the premium tax credit go directly to insurers to pay a share of their monthly health insurance premiums charged or wait until they file taxes to claim them. A premium tax credit is also available to lawfully residing immigrants with incomes below the poverty line who are not eligible for Medicaid because of their immigration status. To receive a premium tax credit, individuals must be U. In , a Supreme Court decision gave states the choice whether to expand Medicaid to cover adults with incomes below percent of the poverty line. People can use their premium tax credit to buy four different types of plans offered through the marketplace in their state: bronze, silver, gold, and platinum. However, the plans vary, with bronze plans providing the least comprehensive coverage and platinum plans the most comprehensive. Platinum plans would have the least overall cost sharing. For example, a bronze plan will likely have a higher deductible than a silver plan, while a platinum plan will likely have a lower deductible than a silver plan. People can purchase any of the four types of plans. But, cost-sharing reductions which are available to people with incomes up to percent of the poverty line that lower deductibles and the total out-of-pocket costs under the plan, are only available to people who purchase a silver plan. Marketplaces also display catastrophic plans that are less comprehensive than bronze plans, but they are only available to people under the age of 30 and those who receive a marketplace exemption due to hardship or lack of an affordable insurance option. A premium tax credit cannot be used to buy these plans.

Defining Income

This approach — where the tax credit is provided directly to the insurer through the exchange to cover a share of the premiums — reduces the upfront out-of-pocket cost of health insurance for eligible lower income individuals. Members Assistance: Members Kitces. For many clients, the availability of coverage — and especially the support of premium assistance tax credits — may make it easier for them to change jobs, start a new business or consulting practice, or retire early without worrying about health insurance. General Inquiries: Questions Kitces. Similarly, those moving from However, the second part, i. The answer is obvious. Lacie Glover is a staff writer at NerdWallet, a personal finance website. This is a far more cash-flow-friendly approach than requiring them to pay the full amount up front and recover the tax credit later which might result in unmanageable cash flow constraints. Lacie Glover. If the credit was overpaid to the exchange, there is a maximum that can be recovered via the tax return which would be relevant if there was a significant change in income, or potentially in if individuals simply underreport income to qualify for the credit before the income verification rules are implemented. For some uninsured clients, this may represent their first opportunity ever to get access to health insurance without medical underwriting — and with a premium subsidy to help — creating a newfound flexibility for employment and retirement decisions. Additional menu. A double-digit increase in the annual health insurance premium is no longer news.

Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. For many clients, the availability of coverage — and especially the support of premium assistance tax credits — may make it easier for them to change jobs, start a new business or consulting practice, or retire early without worrying about health insurance. We did this for five years Find Advice-Only. Presuming your final tally is correct, your premium increase is a combination of a Bronze plan that has increased in price more than Silver, and a higher income. In fact, in such situations, not only do the new health insurance exchanges ensure access to coverage, but the decline in income associated with such life transitions may actually result in premium assistance tax credits that make coverage remarkably affordable. Then, in we came across this article, making it clear that many more and more affluent people besides us were rearranging their wealth and doing the same thing:.

This is true whether you wwhat on the federal marketplace — at HealthCare. If you qualify, the government will send advance payment directly to your insurance provider, lowering your monthly costs. If you work for a business with fewer than 50 employees, your employer is not required to offer coverage. You can still shop on the what if i make less money after premium tax credit for health care and receive Obamacare subsidies in this case. To know whether you or your family preimum for tax subsidies, you have to estimate your total income for the upcoming year.

If you make less, you may get an extra subsidy. Lacie Glover is a staff writer at NerdWallet, a personal finance website. Twitter: LacieWrites. At NerdWallet, we strive to help you make financial decisions with confidence.

To do this, many or all of the products featured here are from our partners. Our opinions are our. NerdWallet is a free tool to find you monet best credit cards, cd rates, savings, checking accounts, scholarships, healthcare and airlines. Start here to maximize your rewards or minimize your interest rates. Lacie Glover. Easily compare health insurance rates With the NerdWallet health insurance tool, you can: Get instant quotes for individual health insurance plans.

See a price comparison for multiple carriers. Find a plan that fits your budget. Compare quotes. Let’s see what happens to your credit score if I have a bill go to collection.

View your score. Your new score:. We want to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers.

Any comments posted under NerdWallet’s official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated .

Do You Need Health Insurance? I Pay $680 Premium for ACA Plan — JEN TALKS FOREVER

Eligibility Rules

The premium tax credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplacealso known as the Exchange. The size of your premium tax credit is based on a sliding scale. Those who have a lower income get a larger credit to help cover the cost of their insurance. When you enroll in Marketplace insurance, you can choose to have the Marketplace compute an whst credit that is paid to your insurance company to lower what you pay for your monthly premiums advance payments of the premium tax credit, or APTC. Or, you can choose to get all of the benefit of the credit when you file credih tax return for the year.

If you choose to have advance payments of the premium tax credit made on your behalf, you will reconcile the amount paid in advance with the actual credit you compute when you file your tax return. If you maoe no tax, you can get the full amount of the credit as a refund. However, if advance what if i make less money after premium tax credit payments were made to your insurance company and your actual allowable credit on your return is less than your advance credit payments, the difference, subject to certain repayment caps, will be subtracted from your refund or added to your balance. Generally, you purchase health insurance at the Marketplace during an open enrollment period. After an open enrollment period is over, individuals who experience certain life events may qualify for a special enrollment period to buy a health plan through a Marketplace. For details about who is eligible for a special enrollment period, for information about future open enrollment periods, and to learn more about the Marketplace, visit HealthCare. When you ma,e a family member applies for Marketplace coverage, the Marketplace will estimate the amount of the premium tax credit that you may be able to claim for the tax year, using information you provide about your family composition, projected household income, and other factors, such as whether those that you are enrolling are eligible for other, non-Marketplace coverage. Based upon that estimate, you can decide if you want to have all, some, or none of your estimated credit paid in advance directly to your insurance company to lower your monthly premiums.

Comments

Post a Comment