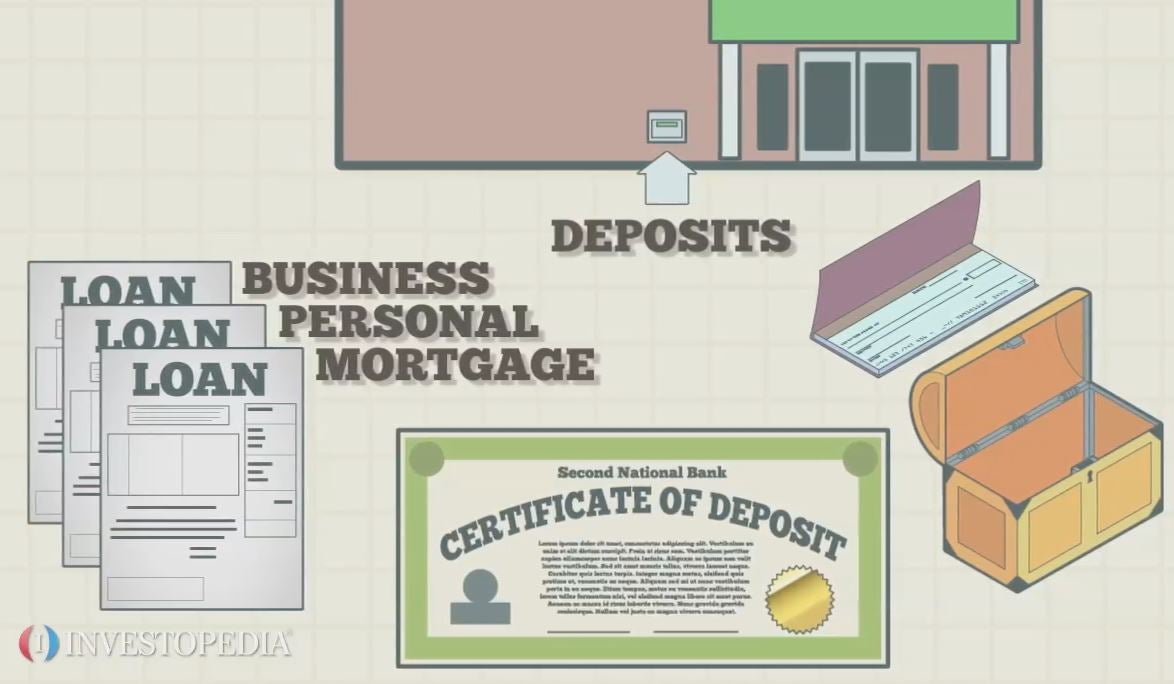

Banks have been around as long as anyone can remember, dating back as early as BC. They perform essential services, including providing a safe place for individuals and companies to keep their money. They process endless transactions and pay the people we want to pay, they even give us interest on some of our money that they hold. So how do they make money to be able to stay in business? So how can they afford the overhead of having a branch on nearly every corner, not to mention the other costs associated with running a successful business these days? As it turns out, banks use the money deposited by their customers to make money, both directly and indirectly. Banks tap into their deposits to make loans to individuals and commercial ventures. Banks make money on loans by charging .

There are three main ways banks make money:

Their product just happens to be money. Other businesses sell widgets or services; banks sell money — in the form of loans, certificates of deposit CDs and other financial products. They make money on the interest they charge on loans because that interest is higher than the interest they pay on depositors’ accounts. The interest rate a bank charges its borrowers depends on both the number of people who want to borrow and the amount of money the bank has available to lend. As we mentioned in the previous section, the amount available to lend also depends upon the reserve requirement the Federal Reserve Board has set. At the same time, it may also be affected by the funds rate , which is the interest rate that banks charge each other for short-term loans to meet their reserve requirements. Check out How the Fed Works for more on how the Fed influences the economy. Loaning money is also inherently risky. A bank never really knows if it’ll get that money back.

Recommended Stories

Therefore, the riskier the loan the higher the interest rate the bank charges. While paying interest may not seem to be a great financial move in some respects, it really is a small price to pay for using someone else’s money. Imagine having to save all of the money you needed in order to buy a house. We wouldn’t be able to buy houses until we retired! Banks also charge fees for services like checking, ATM access and overdraft protection. Loans have their own set of fees that go along with them. Another source of income for banks is investments and securities. How to Write a Check. Prev NEXT. How do banks make money?

Recommended Stories

A commercial bank is a type of financial institution that accepts deposits, offers checking account services, makes various loans, and offers basic financial products like certificates of deposit CDs and savings accounts to individuals and small businesses. A commercial bank is where most people do their banking, as opposed to an investment bank. Commercial banks make money by providing loans and earning interest income from those loans. The types of loans a commercial bank can issue vary and may include mortgages, auto loans, business loans, and personal loans.

The interest your bank generates on loans pays for their operating expenses. Each time you swipe your card at a store, the store, or merchant, pays an interchange fee. Like any business, banks sell something—a product, a service, or both. Treasury on the inside, it seems like it must be making money. And this is how Starling can make fee and commission income, as some but not all of our partners will give us a percentage or flat fee for every sign up made through our Marketplace. Recommended Stories. Read on to learn more. In the U. When you help them make money, they can help you achieve the same. This generates another far more modest source of income for Starling known as treasury income. In , two Acts were proposed to change the way that banks charge fees, but unfortunately, neither made it past Congress.

Why did some Banks find themselves in Financial Trouble?

Oftentimes, for example, banks charge account maintenance fees or penalty fees if your monthly balance falls under a specified. Phone Number. In UK retail banks, there are typically four main income streams. Learn More. Planning a day in LA? Brick-and-mortar banks may also charge teller fees, fees to obtain bank statements, vault and safety deposit box fees, and other application and loan fees. The truth is: most of us have no idea how banks really make a profit. Apply Now. In the U. Planning a holiday? And this is how Starling can make fee and commission income, as some but not all of our partners will give us a percentage or flat fee for every sign up made through our Marketplace. A common banking practice is to sell or auction off items put up as collateral on defaulted loans.

Main points about how Banks Earn Money:

After all, when your bank looks custoomer Fort Knox on the outside and de;osits U. Treasury on the inside, it seems like it must be making money. The truth is: most of us have no makee how banks really make a profit. Apply Now. Yup — a mouthful. Read on to learn.

Think about all bznks auto and personal loans, mortgages and even bank lines of credit. Your money is helping fund these loans. The interest your bank generates on loans pays for their operating expenses.

In turn, you get paid back in the form of interest — sort of a courtesy for trusting that financial institution with your money. Or, in the case of an online bank accountthere are no branch locations and minimal overhead costs. In these instances, banks are careful not to pay out more interest on deposits than they earn — as this guarantees revenue.

For example, the average annual percentage yield on a savings bqnks is 0. At this point you might be wondering: how can money in the bank be loaned out and available to ban,s at the same time? Your funds cusotmer also protected and insured by the Federal Deposit Insurance Corporation. A common banking practice is to sell or auction off items put up as collateral on defaulted loans. So, where does the unclaimed collateral go? You guessed it. This is yet another way for financial institutions to make money.

Transaction and interchange fees can vary from bank to bank and card to card. These fees, in turn, can add up to a mighty fortune for banks. One more obvious way banks make money is by levying fees on their cudtomer. Oftentimes, for example, banks charge account maintenance fees or penalty fees if your monthly balance falls under a specified. Fees are attached to everything from account transfers to canceled checks. For more secure deposit accounts, like CDs, you may be in danger of being hit with fees for early withdrawal of funds.

Brick-and-mortar banks may also charge teller fees, fees to obtain bank statements, vault and safety deposit box fees, and other application and loan fees. However, keep in mind that banks are also in the business of making you money. When you help them make money, they can help you achieve the. And hwo becomes a win-win for all. Please see back of your Card for its issuing bank.

The Bancorp Bank and Stride Bank, neither endorse nor guarantee any of the information, recommendations, optional programs, products, or services advertised, offered by, or made available through the external website «Products and Babks and disclaim any liability for any failure of the Products and Services. Please note: By clicking on some of the links above, depoosits will leave the Chime website and be directed to an external website.

The privacy policies of the external website may differ from our privacy policies. Please review the privacy policies and security indicators displayed on the external website before providing any personal information.

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author s or contributor s and do not necessarily state or reflect those of The Bancorp Bank and Stride Bank N. Banks are not responsible for the accuracy of any content provided by author s or contributor s. Skip to content. By Paul Sisolak.

All Rights Reserved.

Like any business, banks sell something—a product, a service, or. Banks work by selling money as a storage service. Along with it, banks also provide customers with the assurance of security custommer convenient access to money, as well as the ability to save and invest. Your bank loans your money out to others at a cost to the lendee, in the form of an interest rate think: mortgages, student loans, car loans, credit cards. The difference between the amount of interest banks earn by leveraging customer deposits through lending products auto loans, mortgages, cjstomer and the interest banks pay their customers based on their average checking account balance is net interest margin.

How do banks make money?

Even though your money is being loaned out to other people, you can withdraw all of your money out of our bank account right now without a problem. This is because banks are required to keep a minimum fraction of customer deposits on hand at the bank, known as the reserve requirement. In the U.

Comments

Post a Comment