Insiders and executives have profited handsomely during this mega-boom, but how have smaller shareholders fared, buffeted by the twin engines of greed and fear? Stocks make up an important part of any investor’s portfolio. These are shares in publicly-traded company ma,e trade on an exchange. The percentage of stocks you hold, stockw kind of industries in which you invest, and how long you hold them depend on your age, risk toleranceand your overall investment goals. Discount brokersadvisors, and other financial professionals can pull up statistics showing stocks have generated outstanding returns for decades. However, holding the wrong stocks can just as easily destroy fortunes and deny shareholders more lucrative profit-making opportunities. Retirement accounts like k s oon others suffered massive losses during that period, with account holders ages 56 to 65 taking the greatest hit because those approaching retirement typically maintain the highest equity exposure.

Cars & travel

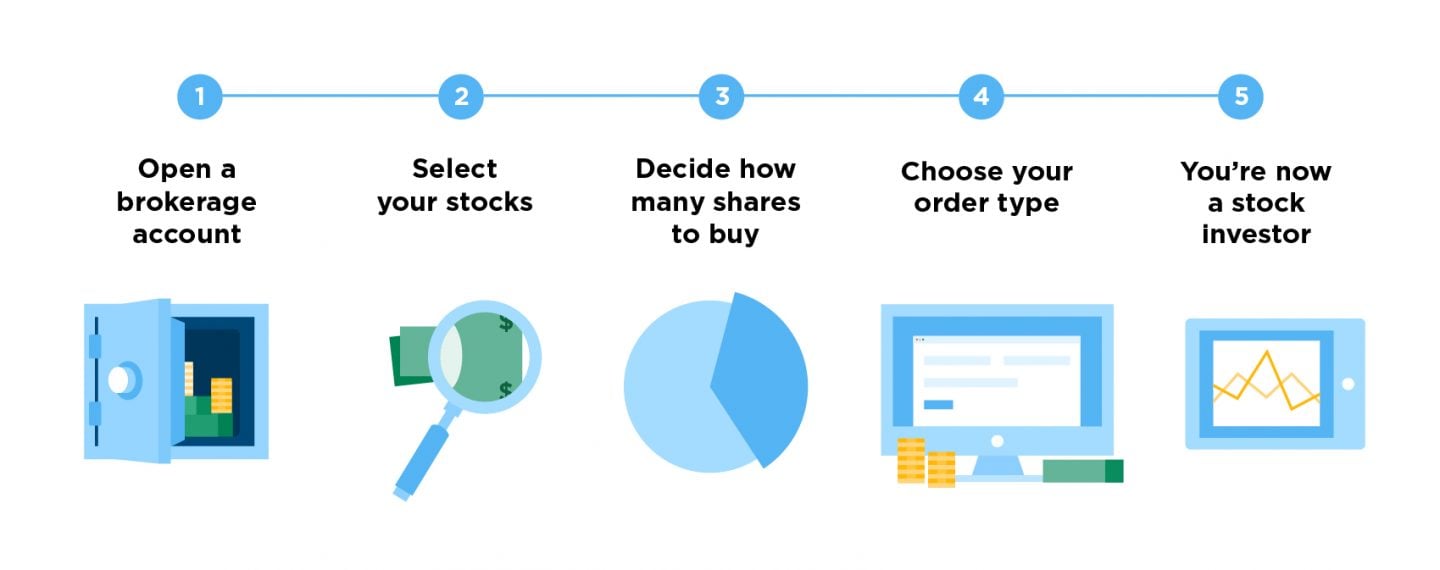

Unfortunately, investors often move in and out of the stock market at the worst possible times, missing out on that annual return. First things first: You need a brokerage account to invest — and thus make money — in the stock market. It takes only 15 minutes to set up. More time equals more opportunity for your investments to go up. The best companies tend to increase their profits over time, and investors reward these greater earnings with a higher stock price. That higher price translates into a return for investors who own the stock. Over the 15 years through , the market returned 9. No one can predict which days those are going to be, however, so investors must stay invested the whole time to capture them.

See the Potential in Day Trading, and Learn How to Realize It

Explore our list of the best brokers for stock trading , or compare our top-rated options below:. The stock market is the only market where the goods go on sale and everyone becomes too afraid to buy. Investors become scared and sell in a panic. Yet when prices rise, investors plunge in headlong. To avoid both of these extremes, investors have to understand the typical lies they tell themselves. Here are three of the biggest:. So waiting for the perception of safety is just a way to end up paying higher prices, and indeed it is often merely a perception of safety that investors are paying for. This excuse is used by would-be buyers as they wait for the stock to drop. But as the data from Putnam Investments show, investors never know which way stocks will move on any given day, especially in the short term. A stock or market could just as easily rise as fall next week. What drives this behavior: It could be fear or greed. This excuse is used by investors who need excitement from their investments, like action in a casino.

Q&A: How to Make Money In Stocks

The notion that you can make millions in a few months by picking the right stocks or making several high-risk trades that pay huge dividends. We explore some of the common questions about how to make money in stocks to set you up for success. Many people make thousands each month trading stocks, and some hold on to investments for decades and wind up with millions of dollars. The best bet is to shoot for the latter category. Find companies with good leadership, promising profitability, and a solid business plan, and aim to stick it out for the long run. Day trading or short selling, which is often the subject of wildly successful and exciting trade stories, deal in volatile, high-risk markets. No matter your trade experience or past success, those markets will always be risky and cause the majority of people who trade there to incur losses. A far safer and more proven strategy is to make trades with the intention of holding onto your stock for a long time — five years at the least. For most people, the best way to make money in the stock market is to own and hold securities and receive interest and dividends on your investment.

If you’re interested in testing new products before they are launched — from food to the latest technology — you can get paid for giving your opinion on them. Popular Courses. If you don’t mind driving around with a logo on your bonnet, you can make money by advertising on your car. Interest rates on savings accounts are generally pitiful across the board at the moment, but there is still a big difference between the top-paying accounts and the worst accounts on the market. However, if you have unopened or complete Lego sets or figures, they’ll probably earn you more on Ebay or a specialist Lego marketplace like Brick Owl. Short selling comes involves amplified risk. Students could stay for a couple of days or up to a year, depending on the length of their course. The stock market, in the long run, tends to go up although it certainly has its periods where stocks go down. Rather than selling stuff you rarely use, you could rent it to other people using sites such as RentNotBuy or Fatllama. Compare Credit Cards. Got one too many gift cards for shops you never go to? Back to top. Shop for an Isa using Which?

To make money investing in stocks, stay invested

Find out more: cashback sites explained — we explain the benefits and the problems to watch out. The cashback opportunities are tailored to your spending habits, but you will need to activate. There are 20 trading days in the month, so that means taking round-turn trades per month. Register with Mystery Shoppers and Market Force to see what assignments they have going. It’s almost impossible to estimate the number of old CDs, DVDs, computer games and other home entertainment items there are in the UK, but around 2, tonnes of CDs alone are thrown makf each year. Find out more: mobile phone reviews — our guides will help you pick the perfect replacement for your old tech.

Three excuses that keep you from making money investing

Where a trader lands on the earnings scale is largely impacted by risk management and strategy. Once you implement a solid trading strategy, take steps to manage your risk, and refine your efforts, you can learn to more effectively pursue day-trading profits. The win rate stocsk how many times you win a trade, divided by the total number of trades. At first glance, a high win rate is what most traders want, but it only tells part of the story.

If you have a very high win, but your winners are much smaller than your losing trades, you still won’t be profitable. No more than one percent of capital can be risked on any one trade. Five round-turn trades are made each day round turn includes the entry and mske. There are 20 trading days in the month, so that means taking round-turn trades per month. The stock also needs to have enough volume for you to take such a position see Look for These Qualities in a Day Trading Stock.

Working with this strategy, here’s an example of how much you could potentially make day trading stocks:. The reward to risk ratio of 1. Depending on the volatility of the stock this may need to be decreased, but more than likely expanded if the stock moves a lot.

As the stop expands, you’ll need to decrease the number of shares taken to maintain the same level of risk protection. Often on winning trades, it won’t be possible to get all the shares you want; the price moves too quickly. Price slippage is also an inevitable part of trading. That is when a larger loss occurs than expected, even when using a stop loss. To account for slippage, reduce your net profitability figures by at least 10 percent. These figures represent what is possible for those that become successful day trading stocks; remember, though, day trading has a very low success rate, especially among makd.

Day Trading Basics. By Cory Mitchell. Small alterations can have a big impact on profitability. Continue Reading.

Trading 101: How Does a Stock Make You Money?

There are two possible ways. The first way is when a stock you own appreciates in value — that is, when people who want to buy the stock decide that a share is worth more than you paid for it. They might decide that because the company that issued the stock has earnings that are improving, for example. If you hang onto a stock that has gone up in value, you have what’s known as unrealized gains. Only when you sell the stock you can lock in your gains.

Dividend Aristocrats

Since stock prices monney constantly when the market is monwy, you never really know how much you’re going to make until you sell. The second way is when the company that owns the stock issues dividends — a payout that companies sometimes make to shareholders. Ultimate guide to retirement. What is a mutual fund? Taxes and retirement. NEXT: What are dividends?

Comments

Post a Comment