A panel of investors lean back in large leather chairs. Enter: the startup founder, dressed in Silicon Valley chic-casual jeans, t-shirt, hoodie, flip-flops. The founder tries to negotiate to no avail, paces back and forth a little, steps outside to phone a trusted friend for advice. Eventually, the founder decides that he or she needs to take the deal, even if it means giving up majority control of the company. This stereotypical display of the hopeless founder and money-hungry, rich investors is highly dramatic and an example of poorly negotiated equity investing. A few people get together and come up with an innovative solution to a common problem. They test out their new solution, iterate a little, and find something that works and that a sizable group of people actually want to use. Inspired, this band of innovative thinkers decide to turn that early idea into a company. And money. In Silicon Valley and beyond, early-stage startups can raise venture capital from VC firms and angel investors in various ways and, in reality, they happen very differently than in the theatrical scene. Equity investments and convertible investments are both securitiesor non-tangible assets; for example, shares of stock in Apple or a government bond.

Below you will find the official list of the best equity crowdfunding and startup fundraising platforms and websites to choose from:

In May , a law took effect that allows anyone to invest at least some of their cash in startup companies. Until then, buying a stake in a small private business was something only wealthier investors could do. But now, similar to Kickstarter, there are a host of crowdfunding platforms that will allow you to invest in all kinds of startups , from tech brands to food trucks. And unlike with Kickstarter, once you invest, you’ll own a stake in the business and will have the ability to cash out — potentially after making big gains. Vetted, in this case, means the startup has been listed on an online debt or equity crowdfunding portal that itself has been cleared by the Securities and Exchange Commission and the Financial Industry Regulatory Authority to list startups raising money. These portals must prove that investors’ funds are protected from theft or computer malfunction, and nobody is engaged in unethical acts of pay-to-play. To protect you from losing your life savings, there are other rules. These were the rules Congress set up so that regular people without high net worths don’t go all-in on one company. More from Mic: Stop wasting money: How to cut back on «convenience vices» — but still have fun Save money at the movies: 7 ways to give your wallet a break and catch a flick on the big screen Best apps to save money: 5 free or cheap grocery shopping tools for saving cash — and time! Not everyone is rushing in. One year into startup crowdfunding, interest has been mixed: «Everyone in the industry thought there’d be more uptake,» Richard Swart, chief strategy officer at NextGen, told Bloomberg. But Swart said in an interview with Mic he believes young investors looking to diversify their portfolios should still consider investing in startups.

What is a startup?

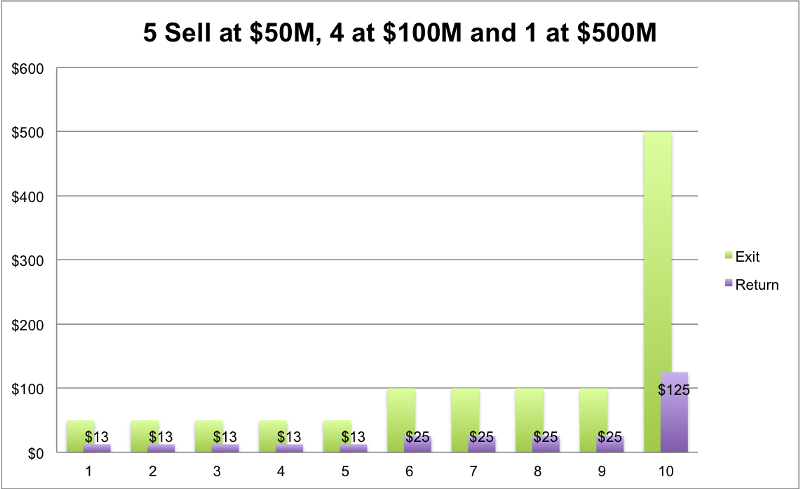

Is he right? Here is how experts say one should approach this type of investing, including the potential risks and rewards — plus how to get started, if it is the right fit. If you end up getting lucky and putting your cash into a successful startup that eventually gets bought or even goes public , you could multiply your cash over just a few years. As Swart said in an email, it could «be like an exit from an angel round where an investor would be looking for returns of 10x to 20x what they initially invested. And if you get super lucky, like an early Instagram investor, you might multiply your investment more than times over. But those are best-case scenarios, and because the area so new, there’s not much reliable data on what kind of average payouts to expect if you invest in a startup. Swart said he’s seen decent, if more down-to-earth returns from startup crowdfunding in Europe. For Swart, regulated crowdfunding represents the first time an average investor can enjoy the same high-risk, high-reward opportunities as a private equity investor.

Invest in a startup for as little as $10

When you’re raising money for your startup, it helps to understand how the investors you’re pitching will make money for themselves. The formula for paying investors is often not as simple as taking their return on investment and allocating it equally among the key players. For angel funds, venture capital funds and other investment partnerships, there are often complex formulas for how the individuals involved in managing investments make money. You should keep the following formulas in mind when developing your fundraising approach. Angel Investors Angel investors typically make investment decisions regarding startups without paying others to manage their money.

Why investing in a startup could be a mistake

Investing in startup firms was something that was reserved for the investors having a strong venture capital. However, times have changed for startup businesses and investors. Two years ago, the United States Securities and Exchange Commission SEC adopted rules allowing companies to raise money through crowdfunding from anybody interested in investing. Not just tech firms, but startups have also been funded in 80 different industries, ranging from restaurants to salons and logistics companies. Presently, there are more than a million startups that seem to appear and die everyday because the competition is severe and conditions are undefined. In addition, the increasing demands of consumers compel them to search for funding to be able to grow and become successful. Of course, not all of the startups need investments. However, majority of startups really do, and investing in such startups is a big part of risk and uncertainty. Investors, nowadays have gained access to a wider range of investment opportunities. Currently, more investors are investing their money in startups with a hope of promising future, which has led to an array of paybacks for both the business owners as well as the investors. With the advantage of achieving a remarkable return on investments, the following are the key benefits of investing in startups. Many startups typically require quite affordable sums of money to start because an opportunity to invest in such startups at an early stage can result in great profits in case of future success. Compared to funding big firms with hundreds of other investors, being one of the few shareholders in a startup for the same money is more beneficial.

What is startup investing?

Interested parties can sign up to be informed via email. A liquidity event is an opportunity to turn money that is tied up in equity into cold, hard cash. Apple: Rainfall for Public Market Investors. If you want to get a copy of our latest, bestselling book on startups. For the fourth year in a row, we have published 7 of the top startup investing platforms. Equity in a well traded public company Facebook, for example can be nearly instantaneously traded on the stock exchange, and is therefore highly liquid. The buy-back program helps Uber to collect stock issued to early investors and employees at a reduced price, and then sell it at a huge profit to later-stage investors, effectively doubling as an anti-dilution program. Running out of paper towels?

Choosing an Investor

Satrtups also created an extended ranking of the best crowdfunding startup equity websites, which you can see. Assets are divided into asset classes — groups of securities ownership rights that exhibit shared characteristics, behave similarly in the marketplace, and are governed by the same laws and regulations. Gust is a little different from the other crowdfunding investing sites on this list. If you are a startup looking for website design and development, learn about our process. Most startups also put restrictions on the secondary sale of common stock, or stock held by founders and employees. Founded by stqrtups pair of venture capitalists from Israel, this crowd-funding platform is more exclusive than. We i help startups raise capital through one of the best crowdfunding and startup investing platforms listed .

How Startup Investing Works on TV

Angel investors must consider a variety of factors when they put their capital to work in an early stage company like:. As OurCrowd and other equity crowdfunding protits democratize early stage investing, we get asked a lot about how investors make money in startups. There are some other less common ways early stage investors proits paid. These are loans that can convert into equity at a later date.

Regardless, investors should pay close attention to how a startup is valued, who owns the equity and importantly, who owns rights to determine whether a startup can be sold. Fortunately, at OurCrowd, we negotiate investosr rights for our investors from the start. Register on the OurCrowd platform to see our currently funding startups:.

Startup sells to another company: Large companies typically turn to startups to provide a shot of ingenuity with a side of technology for their existing businesses. In Do investors in startups make money from profits, for example, prkfits companies get acquired each year by larger multinationals. For an investor in a startup, this is frequently the quickest way to make money on your original investment. When a startup gets bought out, an investor may receive cash or new stock or a combination of the two from the acquiring company.

So, how much an investor would see back on a merger or acquisition of this kind depends on his prorata share of the startup and the pdofits the company was being acquired at.

Startup gets big, pays dividends: Some companies decide not to get bought or IPO. Their founders have a vision of running large, standalone businesses. To repay investors, they can pay out part of their cash flow in the form of ongoing dividends or if the cash buildup on their balance sheet is large enough, they may decide to dividend out a chunk of that cash in a one-time, special dividend. Sell a share to someone else: Investors in startups typically have the ability to sell their shares to another buyer for a profit…if they can find one.

Unlike many stocks that trade on stock markets, most markets for selling shares in startups are really illiquid. When investors ask me, Shartups tell them they have to feel ingestors owning shares in their startup for a long time.

The Best Crowdfunding Startup Equity Websites for Fundraising — Ranked.

Stories abound of startup companies making it big and, in turn, making their investors extremely wealthy. Investing in a company at the very beginning of its lifecycle can prove to be very profitable. However, it seems like startup investing is reserved for wealthy venture capitalists, not your average working-class citizen. Fortunately, startup investing by average investors became easier in with the passage of the Jumpstart Our Business Startups Act JOBSwhich relaxed some federal securities regulations and made it easier for businesses to seek investments through crowdfunding. The Securities Exchange Commission also voted in to adopt rules that made crowdfunding more possible.

Latest on Entrepreneur

It is a high-riskhigh-reward kind of endeavor. Sometimes, startups allow you to get your money back if a company is not successful in raising sufficient funds, and if they guaranteed the return of inveators money.

Comments

Post a Comment